Compound Interest

Calculator

Discover the magic of compound interest - the eighth wonder of the world. Learn how your investments can grow exponentially over time.

Understanding Compound Interest

What is Compound Interest?

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

The Rule of 72

The Rule of 72 is a simple way to determine how long an investment will take to double given a fixed annual rate of interest. Divide 72 by the annual rate of return to get the approximate number of years it will take for the investment to double.

For example: At a 8% annual return, your money will double in approximately 72 ÷ 8 = 9 years.

Tips for Maximizing Returns

Unlock the magic of compound interest – start investing early and watch your wealth grow exponentially over time.

Consistency is key! Regular, small investments can snowball into significant returns.

Accelerate your earnings by automatically reinvesting dividends – it's a simple move with powerful outcomes.

Amplify your financial growth; boost your contributions as your income climbs.

Patience pays off. Commit to the long game and let compound interest propel you towards financial success.

Small Call to Action Headline

The Compound Interest Formula

The formula for compound interest with regular contributions is:

Where FV is future value, P is principal, r is annual interest rate, n is compounding frequency, t is time in years, and PMT is the regular payment.

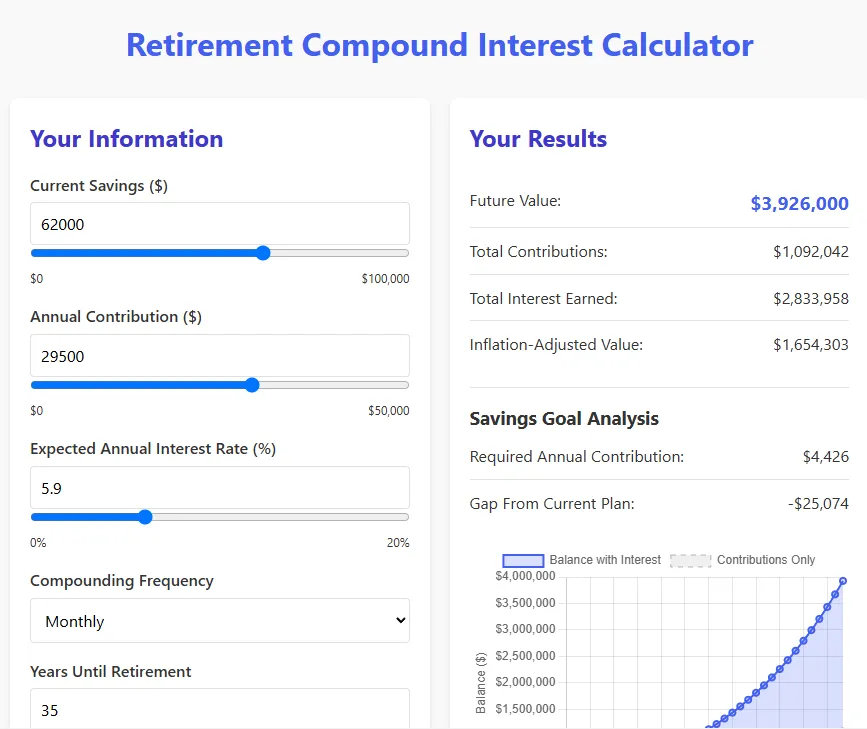

Retirement Compound Interest Calculator

See how your money can grow over time with the power of compound interest.

Retirement Compound Interest Calculator

Your Information

Your Results

Saving Strategies

Our saving strategies help you grow wealth efficiently and securely.

Competitive Price

We offer competitive pricing to maximize your investment returns and growth.

24/7 Support

Our 24/7 support ensures you're never alone in managing investments.

What Client Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Smith

Office Manager

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Rachel Lee

Office Manager

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

Office Manager

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog

Quick Links

6751 N. Sunset Boulevard, Suite 320, GLENDALE Arizona 85305

(602) 538-3862